The custodial services department allocates its costs based on square footage. Assembly occupies 3,000 square feet, accounting for 71 percent of the square footage used to allocate costs. Painting occupies 800 square feet, accounting for 19 percent of the square footage used to allocate costs. Human resources occupies 400 square feet, accounting for 10 percent of the square footage used to allocate costs. The human resources department allocates its costs based on the number of employees.

Related AccountingTools Courses

When calculating unit costs under absorption costing principles each cost unit is charged with its direct costs and an appropriate share of the organisation’s total overheads (indirect costs). An appropriate share means an amount that reflects the time and effort that has gone into producing the cost unit. Both departments should be allocated ignoring the reciprocal services.d. 5 A similar, but less severe criticism can be made concerning the allocations basedon sales values at the split-off point since this method creates equal profit ratios at the point of separation. The net realizable value method and NRV less an average profit margin method are not needed in this case because the products have identifiable market values at the split-offpoint. 2) Solve the system of equations for the service departments [1] simultaneously.

The Company

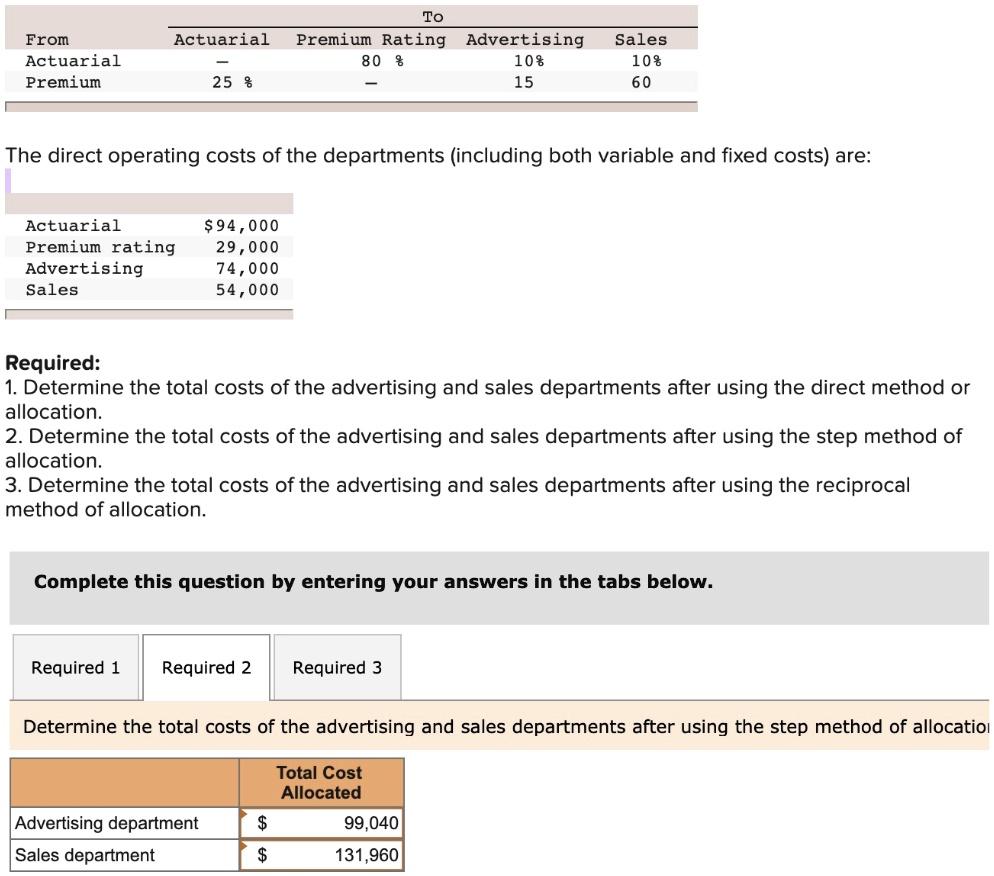

For example, in a hospital, the costs of the housekeeping department might be allocated first, followed by the costs of the maintenance department. This method acknowledges the interdependencies between departments, offering a more nuanced view of cost distribution. However, it can be more complex to implement and requires a thorough understanding of departmental interactions.

Impact of Technology on Allocation Methods

- A complete picture of the reciprocal allocations appears in Exhibit 6-7.

- Of these methods, the reciprocal method is the most complex, but it is also the most accurate.

- The step-down method is more accurate than the direct method, but less accurate thanthe reciprocal method.

Using the “ability to bear”, or percentage of income perspective, gasoline taxesappear to be unfair to low income drivers. However, using the “benefits received” perspective, gasoline taxes appear to be fair. Reciprocal costs are a fundamental aspect of cost allocation in accounting and finance. For learners seeking to understand how costs are distributed across different departments or cost centers, grasping the concept of reciprocal costs is essential.

Advances in Accounting

This guide will delve into the meaning, significance, and methods of dealing with reciprocal costs in easy-to-understand terms. This example showcases how the Reciprocal Method takes into account the mutual services between the IT and HR departments while also allocating costs to the production freshbooks vs nonprofit treasurer 2021 departments based on relevant allocation bases. Another critical aspect of cost allocation in shared services is the need for regular reviews and adjustments. As organizational needs and service usage patterns evolve, the initial allocation bases may no longer be appropriate.

Cost Accounting

A group of joint products is inseparable until the productsreach a certain point where they are divided or split into separate products. Producing more ofone product in the group means producing more of all products in the group. The key characteristic is that the products cannot be obtained separately. Forexample, the lumber products derived from a tree are joint products.

Discuss how a plant wide overhead rate tends to distort product costs. If the company uses the sales value at the split-off point as the allocation basis, the products will appear to be equally profitable at the point of separation. Although someobservers might argue that the products are not equally profitable at the split-off point, this method produces allocations that will not tend to confusethe decisions involved. In addition, the inventory values are acceptable from the financial reporting perspective. Thus, from these two perspectives, thismethod is better than the other three. The allocations based on sales values at the split-off point (See Exhibit 6-17) are more acceptable from both the financial reporting and decision perspectives.

Why do joint costs need to be allocated to the products involved? The accounting techniques that relate to joint and by products are placed in this chapter because these products create special cost allocation problems for systemdesigners. However, this section is placed in an appendix because it represents a sideline topic in the sense that it can be omitted without interfering withthe flow of the learning process. After the simultaneous equations have been solved, the allocations to the producing departments are easily determined by hand as follows.

Critics rebut the previous argument by pointing out that this method sometimes produces a negative cost allocation to some ofthe less profitable products (See the example below). Certainly, approximations of the true costs are better than these confusing cross-subsidies. Departmental overhead rate allocations are illustrated in the top section of Exhibit 6-15.

This approach is best used where some service cost centres provide services to other service cost centres, but these services are not reciprocated. Cost centre C serves centres D and E, but D and E do not reciprocate by serving C. In these circumstances the costs of the service cost centre that serves most other service cost centres should be reapportioned first. We then ‘step down’ to the service cost centre that provides the second most service, and so on.